This blog is just for educational purposes only please do your own research before investing

India's population is projected to grow steadily over the coming decades,

bringing with it significant challenges, particularly in waste management. As

consumption increases, the strain on waste management systems will intensify,

posing risks to public health and quality of life. Effective waste management

is crucial for ensuring a sustainable future.

Antony Waste Handling Cell Ltd. is at the forefront of this challenge, leveraging over 20 years of

experience and advanced technologies to revolutionize waste management in

India. The company has demonstrated that turning "waste into wealth" is

essential for a sustainable environment, positioning itself as a leader in the

industry with innovative solutions.

About Company

Antony Waste Handling Cell Ltd. (AWHCL) was founded in 2001 as part of the Antony Group. It quickly

became a key player in India’s municipal solid waste (MSW) management

industry. The company started with basic waste management services and

expanded over the years to include mechanical sweeping, waste collection,

waste-to-energy projects, and landfill management.

In 2007, AWHCL secured a major contract for an integrated waste management

facility in Kanjurmarg, Mumbai, solidifying its position in the industry.

The company continued to grow, embracing advanced technologies and

sustainable practices.

In 2020, AWHCL went public with a successful IPO, using the funds to reduce

debt and expand operations. Today, it is one of the top five players in

India’s waste management sector, known for its innovative and sustainable

approach to handling municipal waste.

Industry Overview

India’s waste management industry is positioned for significant growth,

driven by the increasing urbanization and industrialization across the

country. As of FY22, the global waste management industry is valued at

approximately ₹35,500 billion, with India's domestic market contributing

₹45 billion. This indicates the vast potential for expansion within the

Indian sector.

The Municipal Solid Waste Management (MSWM) market in India is expected to

double in the next five years, growing at a Compound Annual Growth Rate

(CAGR) of 11.3%. This growth is driven by the rising volume of waste

generation, projected to increase from 60 million tons per annum (TPA) in

FY21 to 70 million TPA by FY26. The Indian market's expansion highlights

the critical need for efficient and sustainable waste management practices

to cope with the increasing waste burden.

On a global scale, India practices a higher rate of open dumping (77%)

compared to the global average. Landfilling remains the dominant method of

waste disposal in India, accounting for 52% of waste management practices,

followed by recycling (25%), waste-to-energy (13%), and composting (10%).

Additionally, the vehicle scrapping market in India is also expected to

see substantial growth by 2030, with significant market size increases

across various states, including Maharashtra, Uttar Pradesh, and Tamil

Nadu.

These trends underscore the importance of adopting advanced waste

management technologies and practices to ensure sustainable growth and

environmental preservation in India.

Market Position

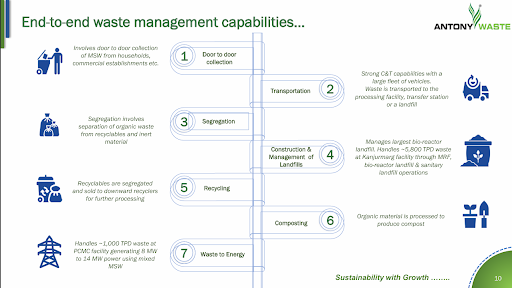

Antony Waste Handling Cell Ltd. is a pioneer in the Municipal Solid Waste

(MSW) management industry, offering a comprehensive range of services

including solid waste collection, transportation, processing, and disposal.

The company also plays a significant role in the creation and management of

landfills. With over two decades of operational experience, Antony Waste has

established itself as a leading player in the industry.

Since its inception, the company has processed 15.20 million metric tons

(mmt) of waste as of H1FY23. Antony Waste has executed projects across 9

states, collaborated with over 23 municipal corporations, and currently

employs more than 10,000 people. The company boasts a portfolio of 35+

completed and ongoing projects, underscoring its strong market presence and

expertise in waste management.

Ownership of One of the Largest Waste Processing Locations in Asia (Tenure: 2010 - 2036)

Antony Waste Handling Cell Ltd. owns and operates one of the largest

single-location waste processing plants in Asia, located at Kanjurmarg in

Mumbai. This site, with tenure from 2010 to 2036, is a critical

infrastructure handling approximately 5,800 tons per day (TPD) of solid

waste, with a total capacity of 7,500 TPD. The facility includes a

bioreactor landfill with a capacity of 6,500 TPD, a sanitary landfill with

a capacity of 250 TPD, and a material recovery and composting facility

capable of processing 1,000 TPD.

The Kanjurmarg site processes about 90% of the total waste generated in

Mumbai, making it a vital component of the city's waste management system.

Additionally, it is one of the largest facilities in Asia for producing

refuse-derived fuel (RDF), which has a gross calorific value exceeding

4,000 cal/g. In Q2FY24, the plant achieved a sale of 29,000 tons of RDF,

highlighting its significant contribution to sustainable waste management

and energy production.

New Waste-to-Energy Project (Tenure: 2019 - 2040)

Antony Waste Handling Cell Ltd. has ventured into the Waste-to-Energy

(WTE) sector with the construction of its first WTE plant in Pimpri,

Maharashtra. The plant, with a capacity of approximately 14 MW of power,

represents a significant investment of around ₹250 crores. The site has a

waste handling capacity of about 800 tons per day (TPD) and was

inaugurated by Prime Minister Narendra Modi in August 2023.

This integrated project encompasses pre-processing, composting, power

generation, and landfill management, making it a comprehensive solution

for waste management. Notably, it is the first municipality in India to

purchase power under the Green Energy open access rules, emphasizing its

commitment to sustainable practices. Commercial sales of power from the

project began in October 2023. The plant is spread over 30 acres of land

provided by the local corporation, marking a significant milestone in the

company's expansion into green energy and sustainable waste management.

Financials

- Market Cap = ₹ 2,112 Cr

- Stock P/E = 24.7

- ROSE = 13.9 %

- Current Price = ₹ 744

- ROE = 16.3 %

- OPM = 20.6 %

- EPS = ₹ 30.1

- Industry PE = 33.5

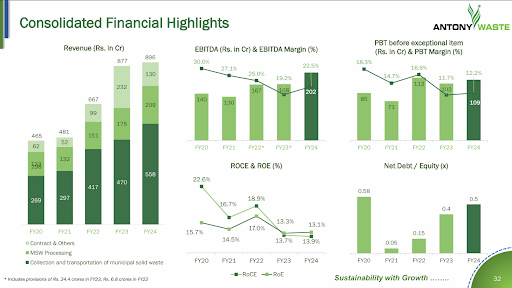

AWHCL is a small-cap company with a PE of 24.7 which is less

compared to industry PE of 33.5 which significantly shows that it is

undervalued and EPS (30.1) is also greater than Stock PE.

Speaking about the financial performance of the company in Q1FY25 it reported

233cr in revenue a net profit of 21cr and an EBITDA of 55cr. if these numbers

are compared with Q1FY24 it has performed a bit well and not much difference.

Debtor days have been increasing continuously since 86 days in Q2FY24, The

Debt to Equity ratio was 0.5 as of Q4FY24 which was reduced to 0.4 in Q1FY25.

The average Cost of Borrowing was 12.4% as of 31st March 2020 which came down

to 9.3% on 30th June 2024.

As of August 2024, the Days Sales Outstanding (DSO) improved to 79 days from 115 days, indicating better cash flow management.

Corporate Structure and Strategic Initiatives

As of Q2FY24, Antony Waste Handling Cell Ltd. has several wholly-owned

subsidiaries (WOSs), including AG Enviro, Antony Infrastructure, KLE, and

Antony Recycling. Additionally, the company holds a 73% stake in its joint

venture, Antony Lara, in partnership with Lara Central De Tratamento De

Residuos LTDA, Brazil.

Looking forward, the company has proposed a strategic merger of its

subsidiaries AG Enviro, Antony Infrastructure, and KLE. This merger aims to

streamline operations, enhance synergies, and position the company for more

robust growth in the waste management sector.

New Contract Acquisition

- Launched the Construction and Debris project in Mumbai on August 14, 2024, addressing the growing need for effective waste management in the region.

- The Ministry of Environment, Forest and Climate Change has proposed guidelines mandating the use of 20% recycled materials in construction, which could boost demand for the company’s services.

Antony Waste Handling Cell Ltd. reported strong financial performance in Q1

FY'25, with operating revenue of ₹198 crores (11% YoY growth) and a total

revenue of ₹232 crores. The company achieved improved operational efficiency

in its Waste-to-Energy plant, managed 1.18 million tons of waste, and recorded

significant growth in the sale of Refuse Derived Fuel (RDF). Strategic

initiatives include launching a Construction and Debris project in Mumbai and

focusing on ESG commitments. Despite challenges like municipal election

impacts on payment cycles, management remains optimistic, projecting a 20%

CAGR in core revenue and exploring new ventures in tire recycling and vehicle

scrappage.